[10000ダウンロード済み√] irs form 9325 instructions 285811-Irs form 9325 instructions

Apr 22, 21 · Form 1 Massachusetts Resident Income Tax Return (PDF KB) Open PDF file, 165 MB, for Form 1 Instructions (PDF 165 MB) For more information about the update to unemployment compensation reporting due to COVID19, visit the link under Related on the righthand side Open PDF file, 9314 KB, forSep 06, · In their knowledgebase, I see instructions for Form 9325 for ATX and Taxwise, though!In either case, blocks 1 and 2 on Form 9325 are completed only after the return has been accepted You can set these options at Setup > Options, on the EF tab (Admin login required) Print 9325 when eligible for EF This option displays a Form 9325 in View when a 1040 return is eligible for EF Although available in View as soon as the return is EF eligible, the form should not be printed and

How To Complete Irs Form 79 Pdf Co

Irs form 9325 instructions

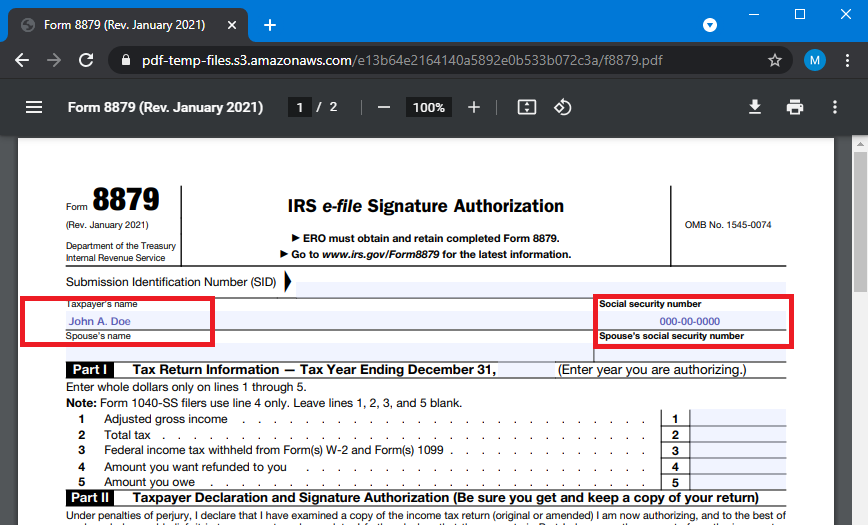

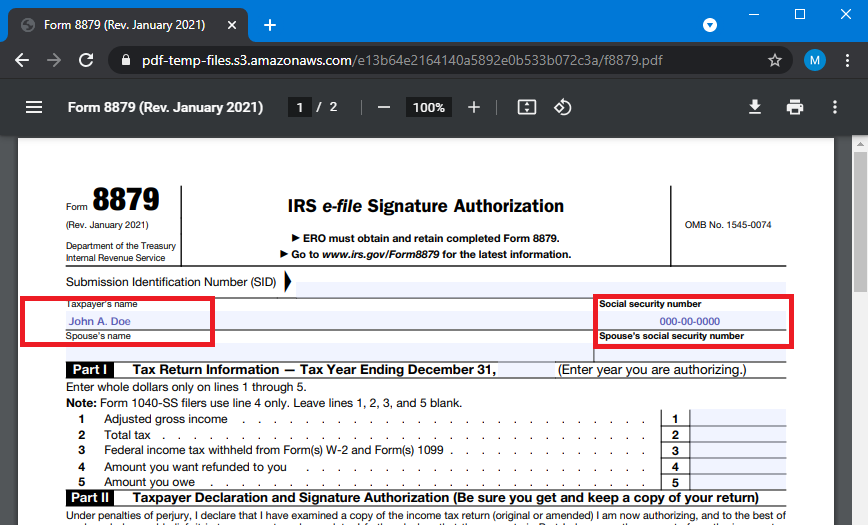

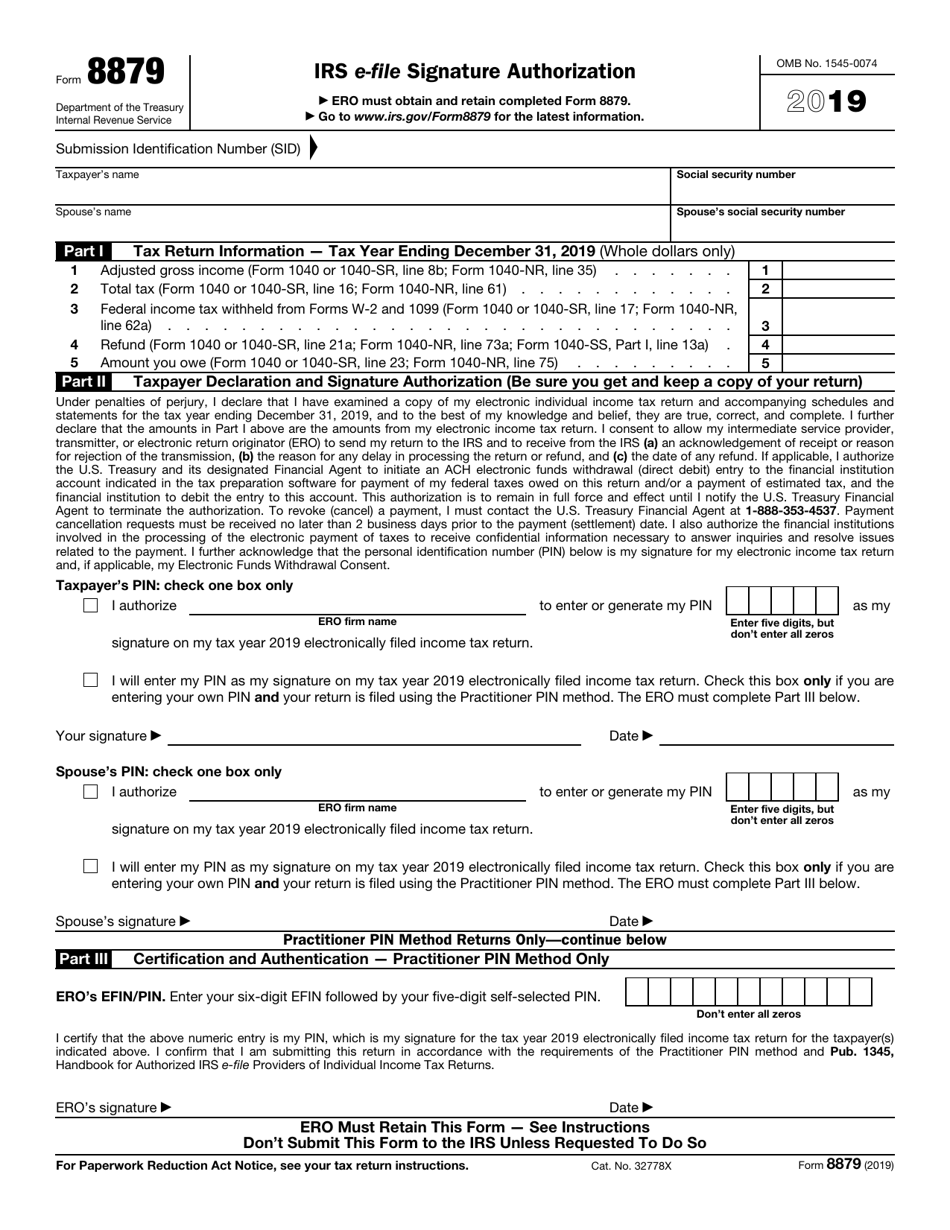

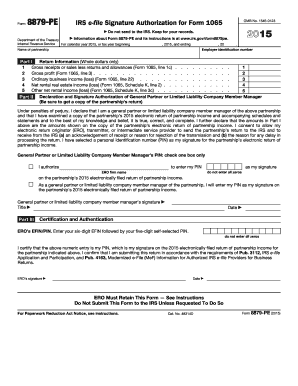

Irs form 9325 instructions-Distributions From Pensions Annuities Retirement or ProfitSharing Plans IRAs Insurance Contracts etc Form Instructions Form 1099 SA Distributions From an HSA, Archer MSA, or Medicare and Choice MSA Form Instructions Form 1116 Foreign Tax Credit (Individual, Estate, or Trust)Form 79 is used to authorize the electronic filing (efile) of original and amended returns Use this Form 79 (Rev January 21) to authorize efile of your Form 1040, 1040SR, 1040NR, 1040SS, or 1040X, for tax years beginning with 19 Purpose of Form Form 79 is the declaration document and signature authorization for an efiled

E Filing Your Tax Returns Advisory Associates

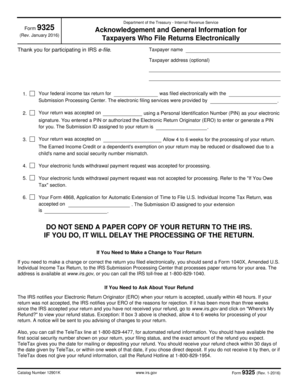

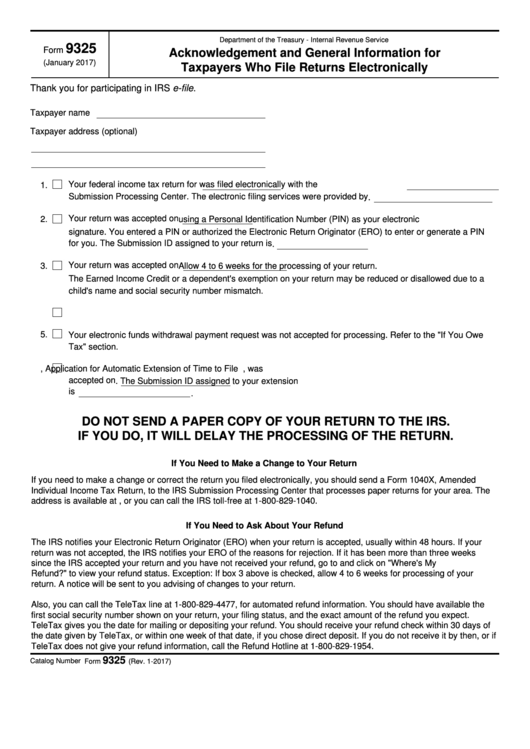

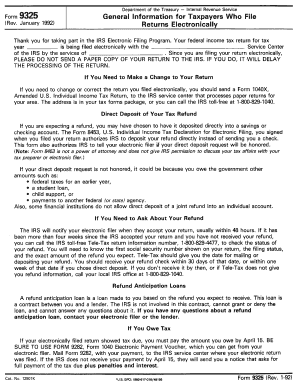

Number (SID) assigned to the tax return, or associate Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, with Form 79 after filing If Form 9325 is used to provide the SID, it isn't required to be physically attached to Form 79 However, it must be kept in accordanceSep 09, · Form 9325 The information in Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, is obtained from the acknowledgements received subsequent to a tax return or an extension request being efiled The form can be produced for one taxpayer or for all taxpayer acknowledgements within a given date rangeFill Online, Printable, Fillable, Blank Form 9325 Acknowledgement and General Information for Taxpayers Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable Form 9325 Acknowledgement and General Information for Taxpayers

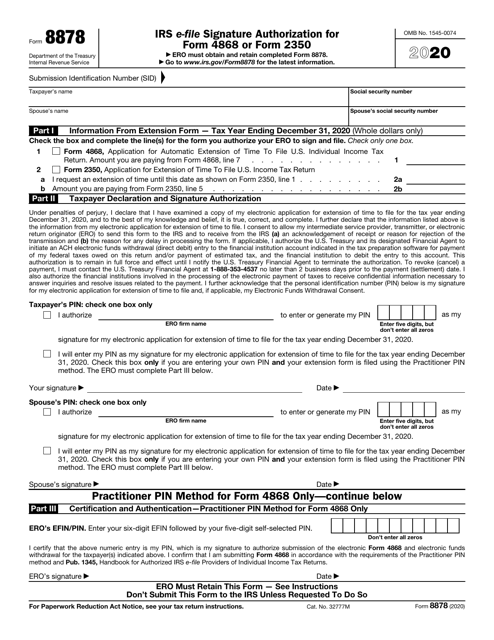

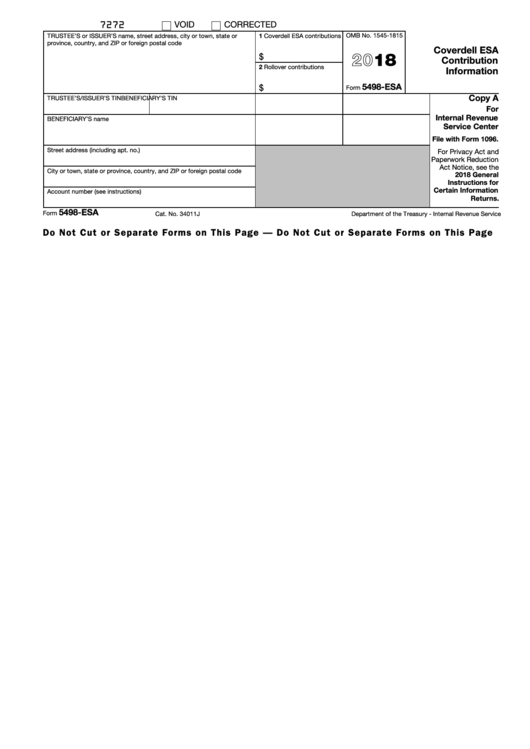

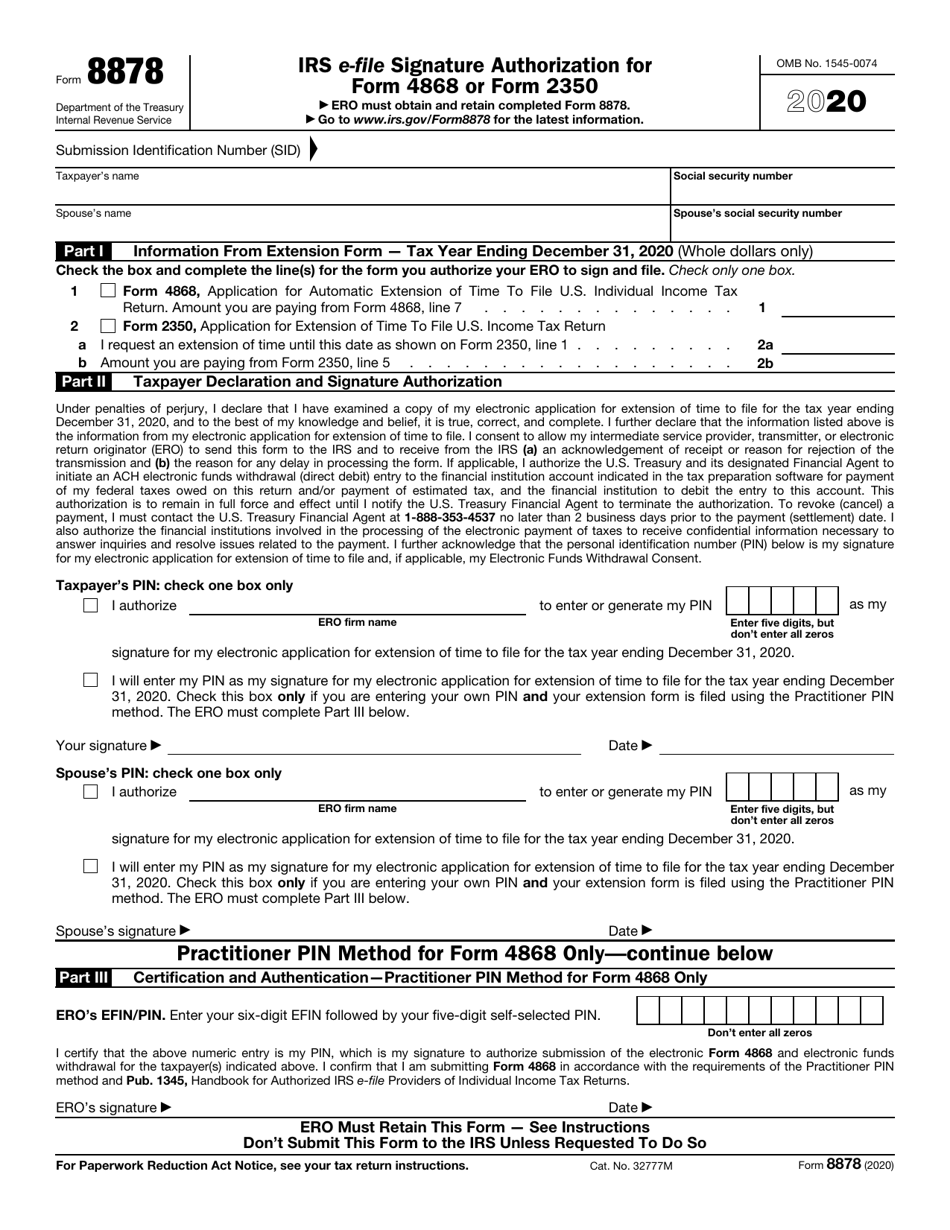

Dec 10, 17 · Instructions for Form W3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version) 03/26/21 Form 5498QA ABLE Account Contribution Information 21 11/30/ Form 5498QA ABLE Account Contribution Information 11/30/ FormIRS efile for corporations, forms 11 and 11S Published (05) The secure way to pay your federal taxes for business and individual taxpayers ;Enter the digit Submission Identification Number (SID) assigned to the taxpayer's extension form, or associate Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, with Form 78 after filing If Form 9325 is used to provide the SID, it is NOT required to be physically attached to Form 78

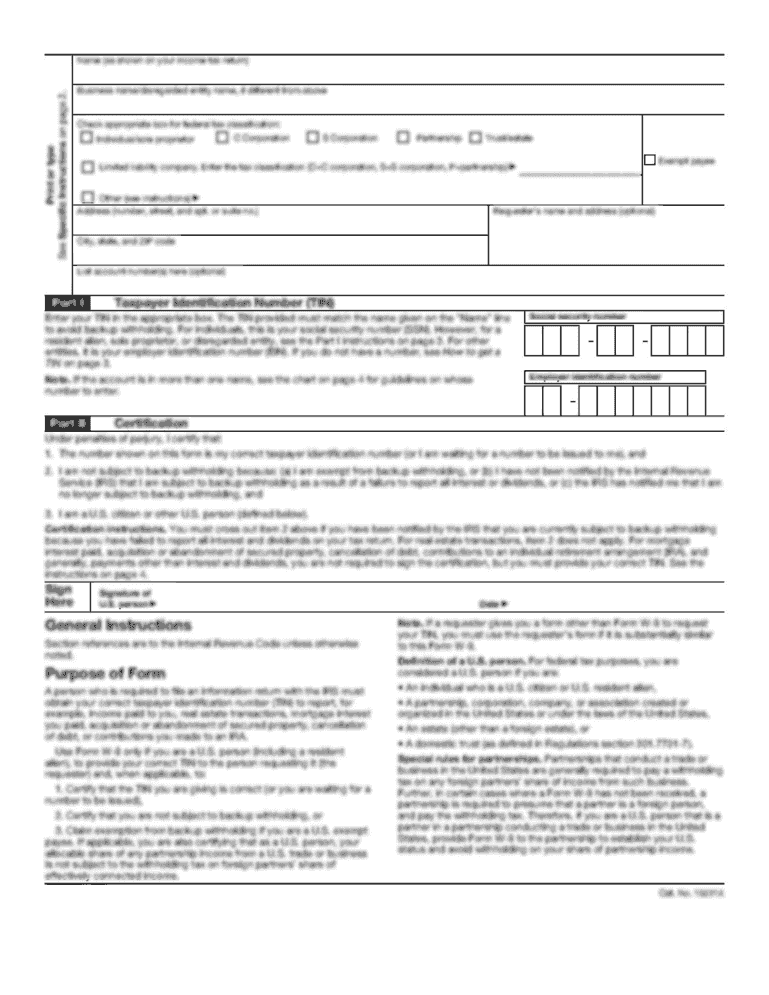

Instructions for Form 78, Partner's Additional Reporting Year Tax 1219 10/31/ Form 78 (Schedule A) Partner's Additional Reporting Year Tax (Schedule of Adjustments) 1219 01/30/ Form 79 Partnership Representative Revocation/Designation and Resignation FormApply a check mark to point the answer wherever demanded Double check all the fillable fields to ensure total precision Utilize the Sign Tool to create and add your electronic signature to signNow the Filling out form 9325 Press Done after you fill out the documentInstructions for IRS Form 6166 Unlike most other forms from the IRS, Form 6166 does not require you to fill out line after line of personal information The US Tax Residency Certificate is obtained through Form 02, which has much more complex instructions and

Www Irs Gov Pub Irs Pdf P1345 Pdf

Fill Free Fillable Irs Pdf Forms

Employers must register with the Internal Revenue Service (IRS) agent must deliver the completed Form UIA 1027 to the purchaser and licenses Mechanical • Sales Tax Elevator • Use Tax Health Facilities You can also obtain Form SS4 at the IRS Web site you can receive your newJun 25, 08 · In this officeForm 79 does not get filed until Form 9325 is attached When there is a Form 79 floating around during tax season, the scramble begins to find out all the information necessary to get the Form 79 in its proper place Several years ago the 9325 was mailed to each client as confirmation KarenInstructions Business Tax General Information Filing Every person subject to Tennessee business tax should file only one business tax return per filing period which includes all business tax due Due Dates Your business tax return is due on the 15th day of the fourth month following the end of your fiscal year

Www Reginfo Gov Public Do Downloaddocument Objectid

How To Know Your Electronically Filed Income Tax Return Was Really Filed

To print Form 9325 for a specific client, from the Main Menu of TaxSlayer Pro select Print Form 9325 Select to print Form 9325, either for a return or extension for a single SSN, or for all returns or extensions accepted by the IRS within a specified date rangeA typed, drawn or uploaded signature Create your eNote By default, UltraTax CS prints the name and address of the taxpayer at the topright of Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically To have UltraTax CS print the taxpayer's name and address leftjustified, choose Setup > Entity (for example, 1040 Individual), click the Federal tab, click the Other Return Options, click the Return

Form 79 Rev January 21 Pdf Dochub

/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

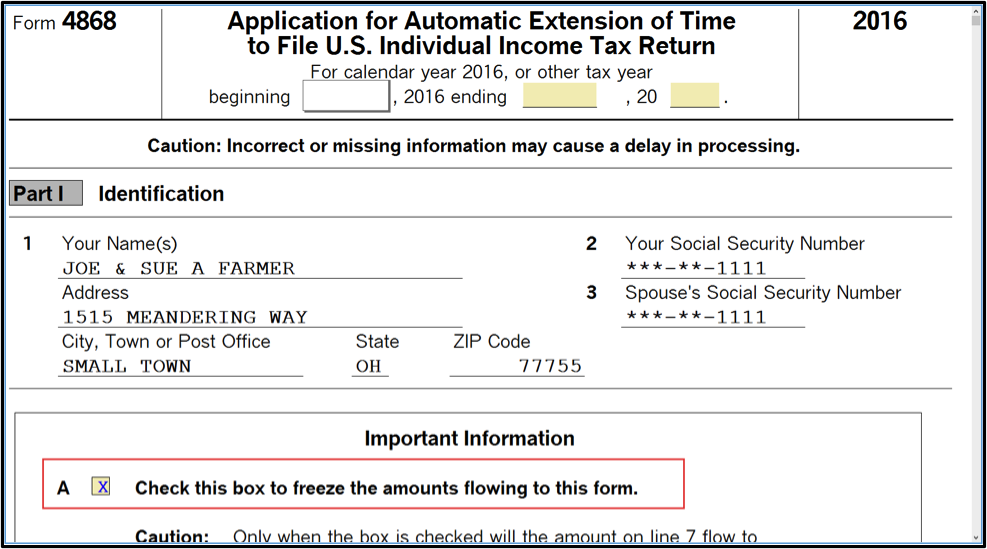

Form 4506 Request For Copy Of Tax Return Definition

Follow the stepbystep instructions below to esign your form 9325 19 Select the document you want to sign and click Upload Choose My Signature Decide on what kind of esignature to create There are three variants;Mar 14, 12 · 18 February 11 My current procedure for having my clients sign Form 79 is as follows 1 Prepare return 2 When husband picks up the returns, I provide him with the 79 to take home and have signed by his spouse (I have signed as ERO on the 79 already) 3 79 is returned to me via faxJun 28, 17 · The extension includes IRS Forms 4868, 26 and 2350 The efile acceptance letter replaces Form 9325, while providing important information to your client The efile acceptance letter for an accepted tax return includes Date of acceptance and the applicable service center A contact phone number for the IRS

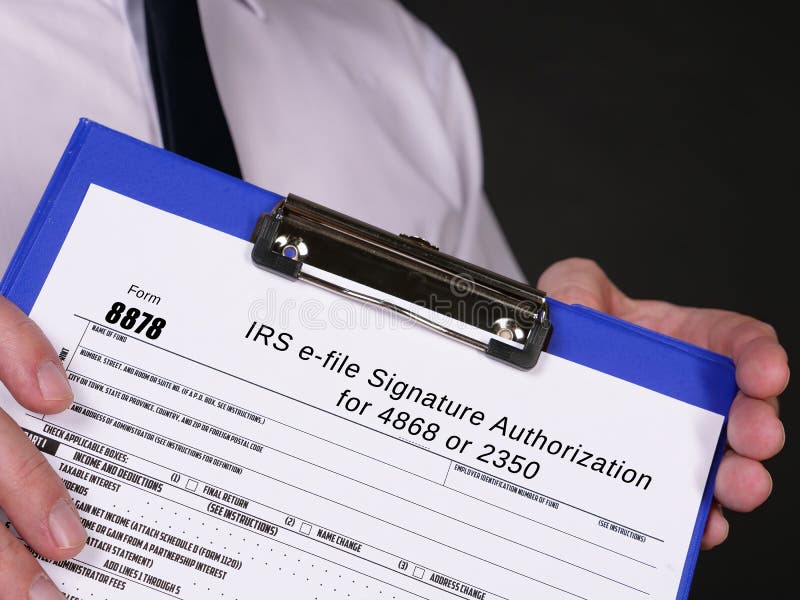

T A X F O R M 8 8 7 9 Zonealarm Results

Proseries Extensions And How To Report Them Tax Pro Center Intuit

Note EROs can use the Acknowledgement File information, translated by the transmitter, to complete Form 9325 Catalog Number K Form 9325 (Rev 109) The IRS uses refunds to cover overdue taxes and notifies you when this occurs The Financial Management ServiceForm 9325 Acknowledgement and General Information for Taxpayers Who File Returns Electronically You may also order Form 9465 by calling 1800TAXFORM () If approved, the Instructions for Electronic Return OriginatorsEasily complete a printable IRS 9325 Form 17 online Get ready for this year's Tax Season quickly and safely with pdfFiller!

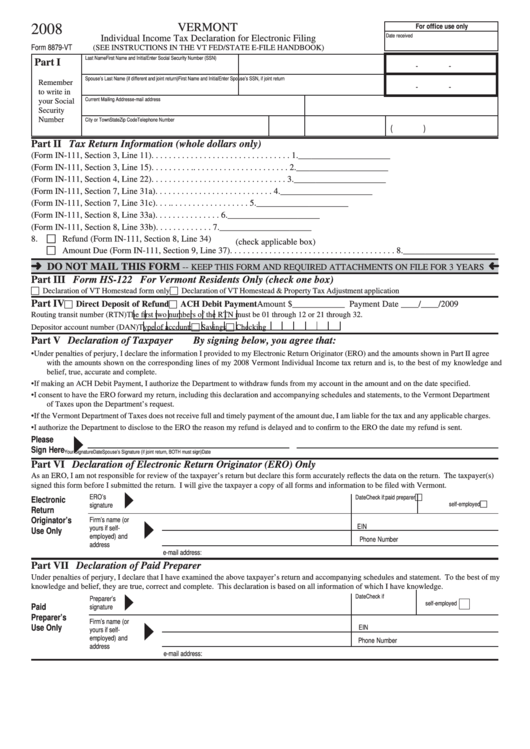

Irs Form 78 Download Fillable Pdf Or Fill Online Irs E File Signature Authorization For Form 4868 Or Form 2350 Templateroller

/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

Follow our easy steps to have your Irs Form 9325 prepared quickly Pick the web sample from the library Enter all necessary information in the required fillable fields The userfriendly drag&drop user interface makes it simple to include or move fieldsMar 28, 21 · If you want to save a copy of the original (wrong) return, save a copy of it with a different name (be sure you uncheck the EF boxes on the fed and state on that copy or you'll end up with a message of duplicate SSN in the EFcenter) , keep the actual original file with the original file name to use as the amended return 0321 1258 PMInternal Revenue Service Form 9325 (Rev January 12) Catalog Number K 9325 (Rev 112) The IRS uses refunds to cover overdue taxes and notifies you when this occurs The Financial Management Service Instructions for Electronic Return Originators Line 2

Irs Forms Tax Forms Irs Extension Form Defensetax

Irs Forms Publications Lattaharris Llp

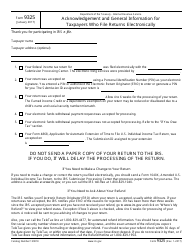

Form 9325 (Rev January 14) Department of the Treasury Internal Revenue Service Acknowledgement and General Information for Taxpayers Who File Returns Electronically Thank you for participating in IRS efile Taxpayer name ANA ALFARO ~~~ Taxpayer address (optional) 38 SINCLAIR STREET WI NDSOR CT 1Form 9325 The information in Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, is obtained from the acknowledgements received subsequent to a tax return or an extension request being efiled The form can be produced for one taxpayer or for all taxpayer acknowledgements within a given date rangeScreening Sheet for Volunteers Assisting Taxpayers with Form 1099C N746 Information About Your Notice, Penalty and Interest P1321 Special Instructions for Bona Fide Residents Of Puerto Rico Who Must File A US Individual Income Tax Return (Form 1040 or 1040A)

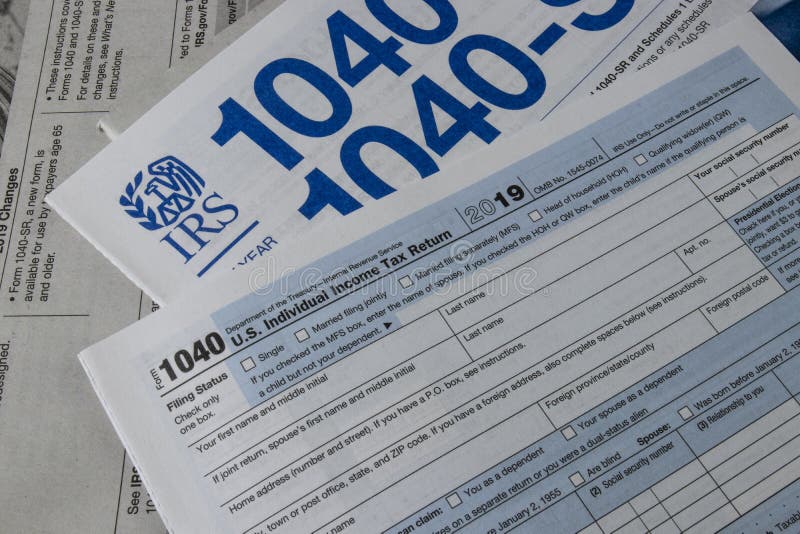

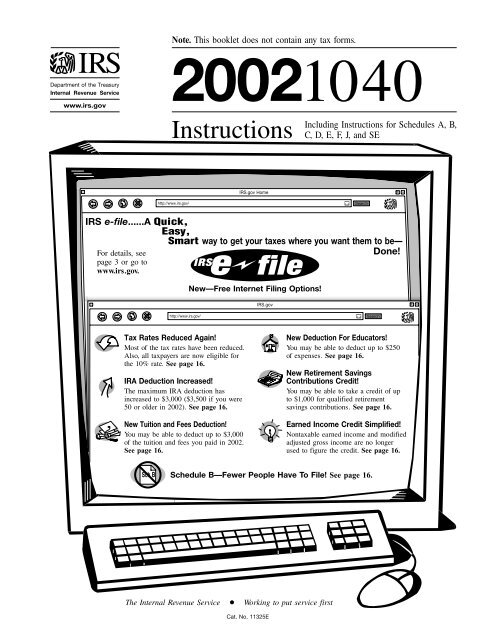

Form 1040 Instructions

Ecfsapi Fcc Gov File Pdf

Wwwirsgov Form 9325 (Rev 117) Form 9325 (January 17) Department of the Treasury Internal Revenue Service Acknowledgement and General Information for Taxpayers Who File Returns Electronically Thank you for participating in IRS efile Taxpayer name Taxpayer address (optional) 1 Your federal income tax return for was filed electronically with theMAIN Taxes US IRS Tax Forms IRS Tax Forms & Instructions for Filing Your Taxes in 21 IRS federal tax forms (below) STATE TAX FORMS What's new this year While the traditional deadline for filing taxes is April 15, the IRS announced in midMarch that they will be delaying the 21 tax filing deadline to Monday, MAY 17 due to the pandemic The extended deadline appliesTo print Form 8453 filing instructions for all indicated attachments, mark the List all indicated attachments in Form 8453 Filing Instructions checkbox in the Other tab In accordance with the IRS form design, the taxpayer's address is rightjustified when the facsimile of Form 9325

2

Irs Forms Tax Forms Irs Extension Form Defensetax

United States Internal Revenue Service Preferred Title Form 9325, acknowledgement and general information for taxpayers who file electronically (Online) Title Form 9325, acknowledgement and general information for taxpayers who file electronically electronic resource Format Journal, Periodical Online Resource URLUse the 1098 form to report mortgage interest 1099K form Everything you need to know Form 5498 For retirement account contributions IRS Schedule K1 for estate and trust income Form 1099R for retirement account distributions Form 15E for retirement plans Form 1095C Amended tax returns and Form 1040XA helpful rep researched and added my request to enhancements for and directed me to the efile page which I already uploaded The lender, of course, had them sign Form 4506 to get return copies asfiled

12 444 Form File Photos Free Royalty Free Stock Photos From Dreamstime

Filing Returns Electronically

Internal Revenue Service t Tax products CDROM w (DLC) w (OCoLC) 787 1 a United States Internal Revenue Service t Reproducible copies of federal tax forms and instructions w (DLC)sn w (OCoLC) 856 4 0IRS forms which are most popular includes irs form 1040, form w4, w9 form, form 941, form 49, form 49, form 4868, form 1023, form 990, form 2848, form 1065, form 1099, form 4506t and form 63The IRS is infamous for having more forms and publications than most taxpayers can even begin to count But all that paperwork is necessary because of our manyTitle form 9325 (rev ) subject acknowledgement and general information for taxpayers who file returns electronically created date 4/14/1999 pm

Fill Free Fillable Irs Pdf Forms

Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically 14 Free Download

In accordance with the IRS form design, the taxpayer's address is rightjustified when the facsimile of Form 9325 is printed To have the taxpayer's address print leftjustified on the facsimile of Form 9325, mark the Print Form 9325 taxpayer mailing address leftjustified checkbox in the Other group box in the Return Presentation tabForm 3800General Business Credit Form 3903 Moving Expenses Form 4136 Credit for Federal Tax Paid on Fuels Form 4137 Tax on Unreported Tip Income Form 4255 Recapture of Investment Credit Form 4506 Request for Copy of Tax Form Form 4562 Depreciation and Amortization Form 4684 Casualties and TheftAfter completing items (1) through (4) above, give the taxpayer Form 79 for completion and review This can be done in person or by using the US mail, a private delivery service, fax, email, or an Internet website Enter the digit Submission Identification Number (SID) assigned to the tax return, or associate Form 9325, Acknowledgement

Form 9325 After Irs Acceptance Notifying The Taxpayer

Dochub Com Ataxpreparation M1kro8r F79 Pdf

IRS or Federal Tax Forms Below are some common IRS forms used to settle, pay, file and resolve IRS problems or unpaid taxes Forms typically will provide instructions but understanding when to use a particular form is importantCreate a blank & editable 9325 form, fill it out and send it instantly to the IRS Download & print with other fillable US tax forms in PDF No paper No software installation Any device and OS Try it Now!How to complete any Form 9325 online On the site with all the document, click on Begin immediately along with complete for the editor Use your indications to submit established track record areas Add your own info and speak to data Make sure that you enter correct details and numbers throughout

T A X F O R M 8 8 7 9 Zonealarm Results

Irs Forms Publications Trout Cpa

The way to submit the IRS 9325 online Select the button Get Form to open it and begin modifying Fill out all required lines in the selected file utilizing our advantageous PDF editor Turn the Wizard Tool on to Ensure the correctness of filled details Include the date of submitting IRS 9325Instructions for Form 941M, employer's monthly federal tax returnAdditional Federal Tax Forms This page contains links to the most commonly used ancillary forms If you need form 1040, form 1040A, or form 1040EZ click on the preceding links Do Your Taxes Online, For Free If you want to avoid costly mistakes, while at the same time taking advantage of all credits and deductions, you'll want to do your taxes with TurboTax this year

Filing Returns Electronically

Fillable Online Irs Form 9325 Rev 1 16 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Irs Fax Email Print Pdffiller

Yes, however, the SID is not available before a return is accepted Beginning in Drake15, t he full SID is displayed on Forms 78, 79 and 9325, after an acceptance acknowledgement is processed On Form 9325, the DCN also is displayed if the transmission is for a 4868 In a business return, the SID is displayed on the EF_ACK pageIRS Form 02 is also known as the Application for United States Residency Certification It allows individuals and companies to claim tax treaty benefits while working or operating in foreign countries by proving their US residency This proof comes in the form of a Tax Residency Certificate, also known as Form 6166, and can be issued to the

2

1040 Internal Revenue Service

Business Returns Ef Notice Page Similar To Form 9325

12 444 Form File Photos Free Royalty Free Stock Photos From Dreamstime

Fillable Online Form 9325 Rev October 03 Fill In Version Fax Email Print Pdffiller

21 Current Year Irs Tax Forms For Filing Taxes In 21

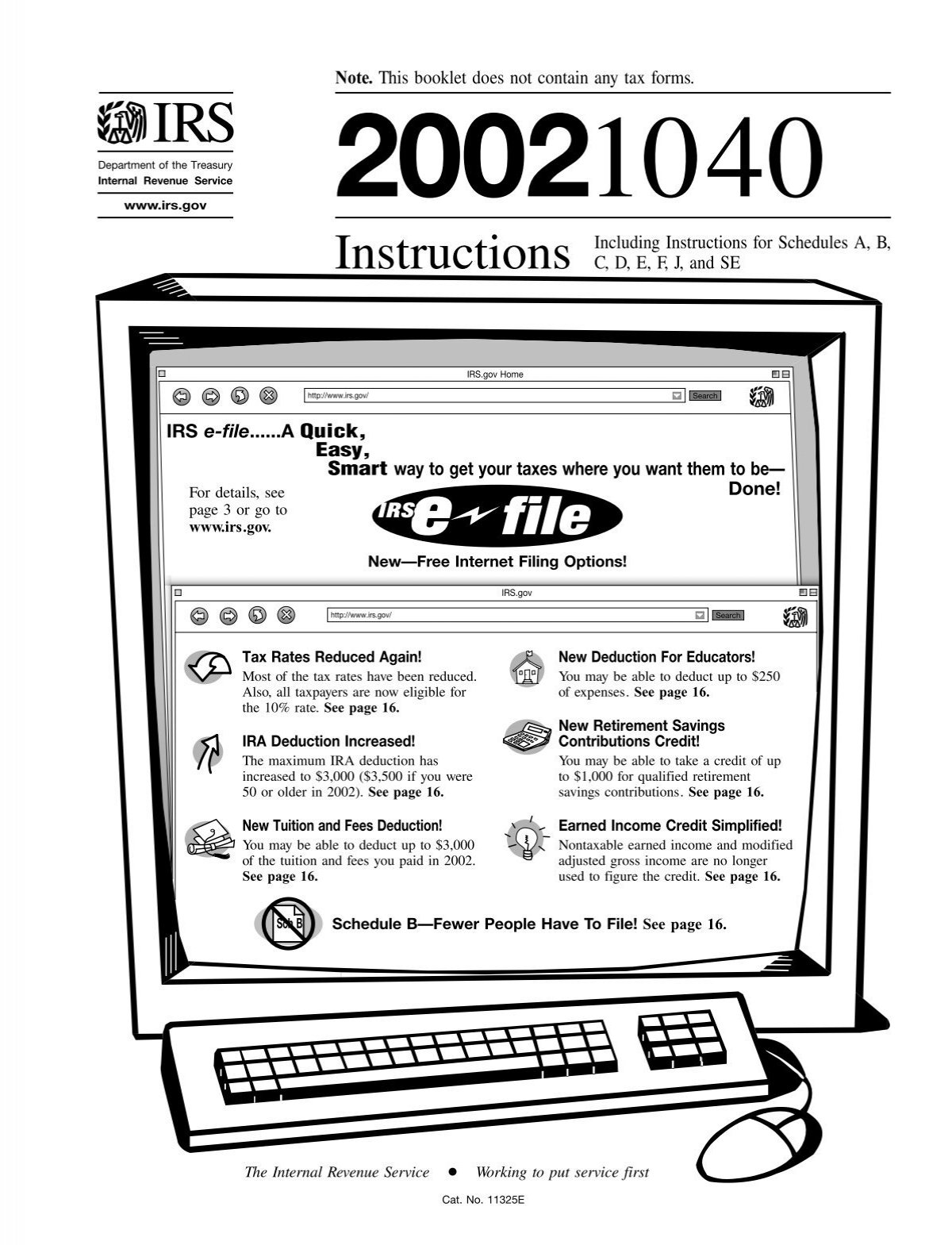

Instructions For Form 1040 Uncle Fed S Tax Board

Fillable Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Printable Pdf Download

6742 Irs Forms And Templates Free To Download In Pdf

/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

1040 Internal Revenue Service

17 Instructions For Form 5329 Internal Revenue Service Instructions For Form 5329 Pdf4pro

Http Vanblakesinc Com Userfiles File F79 Accessible Pdf

How To Complete Irs Form 79 Pdf Co

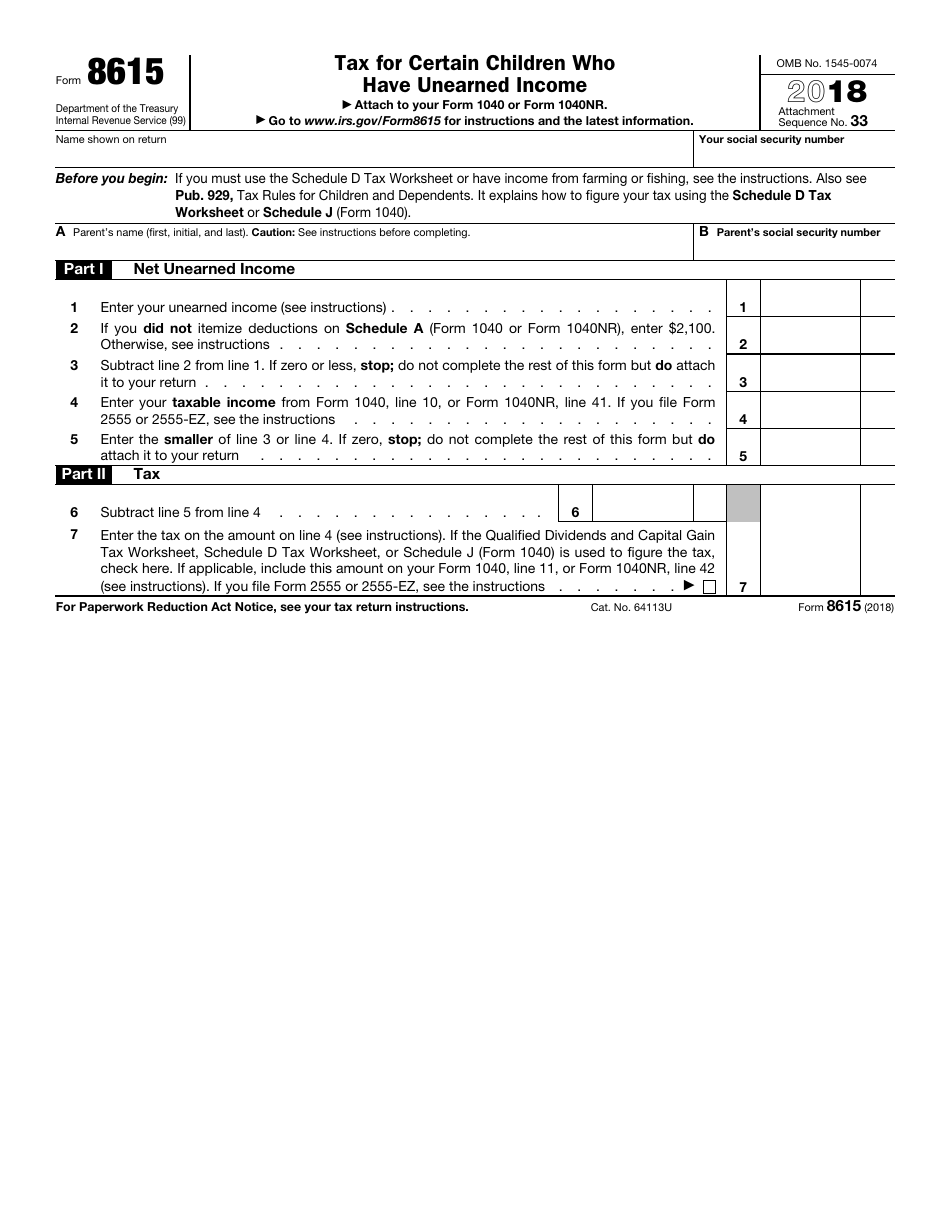

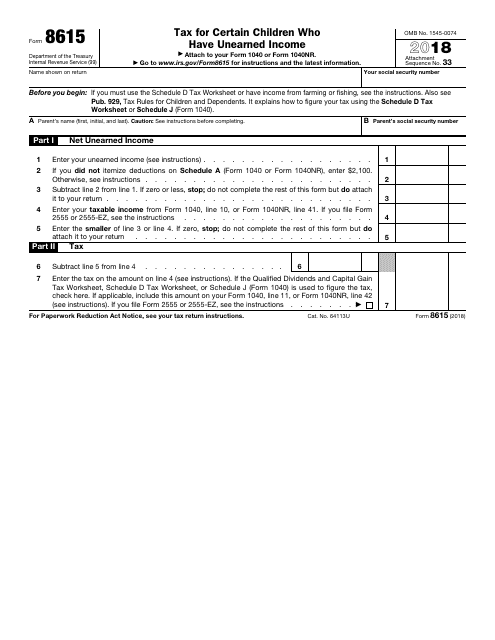

Irs Form 8615 Download Fillable Pdf Or Fill Online Tax For Certain Children Who Have Unearned Income 18 Templateroller

Www Irs Gov Pub Irs Prior F78 17 Pdf

Fill Free Fillable Irs Pdf Forms

1040 Internal Revenue Service

17 Instructions For Form 5329 Internal Revenue Service Instructions For Form 5329 Pdf4pro

Irs Form 9325 Fill And Sign Printable Template Online Us Legal Forms

I R S F O R M 8 8 7 9 P R I N T A B L E Zonealarm Results

Fill Free Fillable Irs Pdf Forms

Fillable Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically Printable Pdf Download

U S Income Tax Return For Single And Joint Filers With No Dependents Forms Instructions Tax Table By Legibus Inc Issuu

T A X F O R M 8 8 7 9 Zonealarm Results

Form 79 Irs E File Signature Authorization 14 Free Download

Filing Returns Electronically

Irs 79 Pe Form Pdffiller

Fillable Online Irs Form 9325 Rev 01 1992 Irs Fax Email Print Pdffiller

Tx Cube Tax Service Individual Income Tax Preparation Engagement Letter 19 21 Fill Out Tax Template Online Us Legal Forms

Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Prosystem Fx Electronic Filing User Guide Support Manualzz

1040 Internal Revenue Service

Form 78 Irs E File Signature Authorization For Form 4868 Or Form 2350 14 Free Download

E Filing Your Tax Returns Advisory Associates

13 Form 79 Internal Revenue Service 79 Department Of The Treasury Internal Revenue Service Irs E File Signature Authorization Do Not Send To The Irs This Is Not A Tax Return Pdf Document

Form 9325 Acknowledgement And General Information For Taxpayers Who File Returns Electronically 14 Free Download

Form Ct 1 Employer S Annual Railroad Retirement Tax Return 14 Free Download

Form 78 Fillable Irs E File Signature Authorization For Form 4868 Or Form 2350

Ecfsapi Fcc Gov File Pdf

Filing Returns Electronically

Form 9325 After Irs Acceptance Notifying The Taxpayer

Www Unclefed Com Irs Forms 00 F9325 Pdf

Ecfsapi Fcc Gov File Pdf

T A X F O R M 8 8 7 9 Zonealarm Results

Tax Newsletter November Secure Act Part 2 Basics Beyond

Irs Forms High Res Stock Images Shutterstock

Irs 9325 17 21 Fill And Sign Printable Template Online Us Legal Forms

12 444 Form File Photos Free Royalty Free Stock Photos From Dreamstime

Fill Free Fillable F9325 Accessible Form 9325 Rev 1 17 Pdf Form

Irs Published Products Catalog

Libro 9 Derecho Romano Irs Tax Forms Income Tax In The United States

Submission Id Sid

Instructions For Form 1040

17 Instructions For Form 5329 Internal Revenue Service Instructions For Form 5329 Pdf4pro

Irs Form 78 Download Fillable Pdf Or Fill Online Irs E File Signature Authorization For Form 4868 Or Form 2350 Templateroller

Instructions For Form 540 2ez California Franchise Tax Board

Tax Year 17 Drake Software Manualzz

Client Communications E File And Paper File Options Drake19

Irs Form 9325 Download Fillable Pdf Or Fill Online Acknowledgement And General Information For Taxpayers Who File Returns Electronically Templateroller

Www Unitedwaynems Org Wp Content Uploads 21 02 Irs Form 1040 Instructions Pdf

Fill Free Fillable Irs Pdf Forms

12 Form Irs 79 Fill Online Printable Fillable Blank Pdffiller

F79 Pdf Dochub

Tax Debt Tax File Editorial Stock Image Image Of Back

17 Form 79 Internal Revenue Service E File Signature Authorization Return Completed Form 79 To Your Ero Do Not Send To Irs Go To

Instructions For Form 1040 Uncle Fed S Tax Board

Www Uwwashtenaw Org Sites Uwwashtenaw Org Files Form79 e File authorization Pdf

January 14 Taxable Talk

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Cs Thomsonreuters Com Support Reference Pdf Ub21 Pdf

Business Returns Ef Notice Page Similar To Form 9325

Irs Form 8615 Download Fillable Pdf Or Fill Online Tax For Certain Children Who Have Unearned Income 18 Templateroller

13 Form 79 Internal Revenue Service 79 Department Of The Treasury Internal Revenue Service Irs E File Signature Authorization Do Not Send To The Irs This Is Not A Tax Return Pdf Document

コメント

コメントを投稿